The Creative Compassion-II

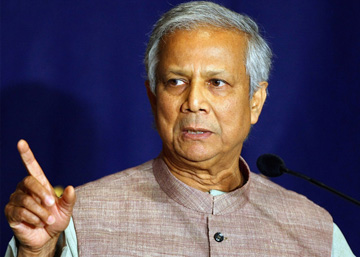

The second part of the case study based on the autobiography of Muhammad Yunus, Banker to the Poor, The University Press. Muhammad Yunus is a Nobel Laureate in Peace and the founder of Grameen Bank, Bangladesh.

Key Perspectives

The feminine advantage; harnessing the power of groups; business model; poverty, profit and beyond

The Feminine Advantage

One of the first major decisions of Yunus in his Grameen Bank is to lend only to women. This is a radical decision which went against the values of the traditional Islamic society of Bangladesh and also the modern secular values of gender equality. But it is a practical decision which is perhaps a major factor behind the Grameen success story. The distinguished management thinker, C.K. Prahalad states categorically “Grameen Bank’s success is based on lending only to women.” Yunus seemed to have felt instinctively that women are much more honest, reliable and credit-worthy borrowers than men and his instincts turned out to be true. As Yunus points out, “Our experience with bad debt is less than 1 percent.” In his autobiography Yunus devotes an entire chapter to explain, “Why Lend Women Rather to Men,” and gives many reasons for preferring woman over men. Here are some of them:

“From our experience, it became evident that destitute women adapted quicker and better to the self-help process than men.

Poor women had the vision to see further and were willing to work harder to get out of poverty because they suffered the most.

The women paid more attention, prepared their children to have better lives, and were more consistent in their performance than men.

Money going through a woman in a household brought more benefits to the family as a whole than money entering the household through a man.

On the other hand, a man has a different set of priorities which do not give the family the top position. When a destitute father starts making extra income, he starts paying attention to himself. So why should Grameen approach the household through men?

When a destitute mother starts making some income, her dreams invariably centre around her children.

A mother’s second priority is the household. She wants to buy a few utensils, literally build a stronger roof and improve the family’s living conditions. One of our borrowers was so excited she grabbed a reporter and showed her the single bed she had been able to buy for herself and her family.”

Harnessing the Power of Groups

The other important part of Grameen strategy is formation of borrowers into a group or a community. Yunus recognized the social power of groups. In Grameen Bank, a borrower is a member of a supportive borrower-community. As Yunus explains the advantages of a group:

“We discovered that the formation of a group was crucial to the success of our operations. Individually, a poor person feels exposed to all kinds of hazards. Group membership gives him a feeling of protection. Individually, a person tends to be erratic, uncertain in his or her behaviour. But group membership creates group support and group pressure and smoothes out behaviour patterns and makes the borrower more reliable. Subtle, and at times not so subtle, peer pressure keeps the group members in line with the broader objectives of the credit programme. A sense of inter-group and intra-group competition helps everyone try to be an achiever. It is difficult to keep track of individual borrowers; but if he or she is a member of a group, it is much less difficult. Also, shifting the task of initial supervision to the group reduces the work of the bank worker and increases the self-reliance of the group.”

Yunus describes an interesting and amusing episode which illustrates the positive influence of group which sometimes goes beyond its members to their families. It is a conversation between Yunus and the husband of a borrower:

“‘Are you happy that she joined? Or, looking back, do you think it would have been better if she did not?

No, no, I am happy that she joined. She used to complain that we didn’t have enough food, but now she does not complain. We have enough for the three of us.’

For me this was like getting good grades in the final exam. I was pleased that things were working well. Both Joynal and I kept walking silently.

The long silence was broken when Joynal spoke out in a negative tone:

‘There is one thing, however. I used to enjoy beating my wife. But the last time I beat her I got into trouble. The women in Farida’s borrowing group came to me and argued with me and shouted at me. I did not like that. Who gave them the right to shout at me? I can do whatever I want with my wife. Before, when I used to beat my wife, no one said anything, no one bothered. This is no longer going to be true. Her borrowing group threatened they will get really mean if I beat my wife again.’

I tried to console Joynal:

‘Well, maybe it is time you left your wife alone. After all, she is working very hard. She needs your support. You can find something else to do to release your tension.’”

In Grameen Bank, this borrower community is not only a social unity but also a cultural entity held together by a system of values which provides a sense of meaning and purpose to its members. There are sixteen values, which Yunus calls as “decisions”, it is a comprehensive document which can be the guiding principles for any community development project. These are the “Sixteen Decision” which each member of the borrower community must try to follow:

1. We shall follow and advance the four principles of the Grameen Bank – discipline, unity, courage and hard work – in all walks of our lives.

2. Prosperity we shall bring to our families.

3. We shall not live in a dilapidated house. We shall repair our houses and work towards constructing new houses at the earliest opportunity.

4. We shall grow vegetables all the year round. We shall eat plenty of them and sell the surplus.

5. During the plantation seasons, we shall plant as many seedlings as possible.

6. We shall plan to keep our families small. We shall minimize our expenditures. We shall look after our health.

7. We shall educate our children and ensure that we can earn to pay for their education.

8. We shall always keep our children and the environment clean.

9. We shall build and use pit-latrines.

10. We shall drink water from tube wells. If it is not available, we shall boil water or use alum to purify it.

11. We shall not take any dowry in our son’s weddings, neither shall we give any dowry in our daughter’s wedding. We shall keep the centre free from the curse of dowry. We shall not practice child marriage.

12. We shall not commit any injustice, and we will oppose anyone who tries to do so.

13. We shall collectively undertake larger investments for higher incomes.

14. We shall always be ready to help each other. If anyone is in difficulty, we shall all help him or her.

15. If we come to know of a breach of discipline in any centre, we shall all go there and help restore discipline.

16. We shall introduce physical exercises in all our centres. We shall take part in all social activities collectively.

The Business Model

Most of the poverty-eradication programmes are philanthropic activities done by charitable or funding institutions or as non-profit activities by government agencies. But in the Grameen model of Yunus poverty-eradication is done on business lines. The micro-credit movement pioneered by Yunus is a market-oriented approach where the institution which lends to the poor borrows funds from global financial market at a low interest rate and lends at a higher rate of interest, generating profit in the process. And this profit is ploughed back to expand further the lending operations.

According to Yunus, without profit the lending institutions will not have the financial resources to survive, sustain, expand and reach out to more and more poor people or invest in the infrastructure needed for enhancing the quality of life or living standards of the borrower, like for example what Grameen Bank is doing in education, healthcare, housing, technology, energy. “If Grameen does not make a profit,” says Yunus, “We will be out of business. In Grameen we always run on profit, to cover our cost, in order to protect us from future shocks and to carry on expansion. Our concerns are focused on the welfare of our shareholders (who are the poor borrowers) and not on immediate cash returns on their investment dollar.”

Thus in the Grameen model poverty eradication is a market-oriented process run on for-profit basis. But in this model profit is not an end in itself but only a means for reaching out to a greater number of poor people and for the economic and social upliftment of the borrower-community.

Poverty, Profit and Beyond

The Grameen model of poverty-eradication, conceived and executed by Yunus, is a great, creative and admirable effort towards solving one of the most challenging problems facing humanity. Many economic, management and development thinkers and practitioners consider this market-oriented model as the most effective path to poverty-eradication. For example, James D. Wolfenson, former President of World Bank states:

“Micro-credit programmes have brought the vibrancy of the market economy to the poorest villages and people of the world. This business approach to the alleviation of poverty has allowed millions of individuals to work their way out of poverty with dignity.”

The well-known and distinguished management thinker, C.K. Prahalad in his influential book, “The Fortune at the Bottom of the Pyramid” argues convincingly that market of the rich is now more or less saturated and the future market and the source of profit lies in fulfilling the needs of the millions of poor people in the bottom of the economic pyramid. Many entrepreneurs following Prahalad’s clue, are now venturing into the low-income sector and finding there fertile sources of profit. This has given birth to the notion that poverty eradication need not be left entirely to charitable organizations, NGOs or government, and business can play an important role in fighting poverty. The advent of business into the field of poverty-eradication is very much welcome. In our modern age business is the most powerful, innovative and creative social organism. So, active participation of business in our battle against poverty is bound to have a positive and substantial impact on reducing the poverty and inequality in our society.

However we must not rigidly link poverty with profit. Such a crucially important task as poverty-eradication should not be tied to profit; it has to be pursued with or without profit. We must keep in mind that elimination of poverty requires not only money and business sense but also moral commitment to the task and sympathy for the poor. There are individuals who have a great moral passion and vital energy to dedicate their lives for serving the poor. But they may not have the business sense to create a financially viable model.

These individuals need constant financial support from charitable and funding agencies to engage their potential in the task of poverty-eradication. On the other hand, there are individuals who have the business sense but no moral commitment. They may enter into the low-income sector lured by profit. But they will drop away when the market-condition changes and this Bottom of the Pyramid sector loses its profit-potential. There may also be individual like Mohammad Yunus who can combine moral dedication with business acumen. So for a sustained impetus towards poverty-eradication we must create an environment in which every creative, sincere and dedicated effort towards elimination of poverty, with or without profit, can find sufficient financial support to sustain itself in the long-term.

We must also think beyond poverty. As increasing number of people are delivered from the clutch of poverty and move towards decent standards of living, what next? We, Human beings, have a higher destiny beyond economic survival or prosperity. When the basic needs of the body are reasonably fulfilled it awakens progressively higher order needs of our emotional, mental, moral and spiritual being. As the individual strives to satisfy these higher needs, it awakens the corresponding faculties and potentialities of his mind, heart and soul which leads to his higher evolution. So the task beyond poverty is to create a development framework which promotes this higher evolution, with elimination of poverty as an important and indispensable stage in the process.

[Concluded]

M.S. Srinivasan

The author is a Research Associate at Sri Aurobindo Society and on the editorial board of Fourth Dimension Inc. His major areas of interest are Management and Indian Culture.